Discover how to secure the necessary financial backing for your real estate investments on Investorlift. This guide will take you step by step through the application process on the leading collaborative financing platform for real estate projects. Embark with confidence on your journey to success in real estate investments with Investorlift!

How To Apply For Financing

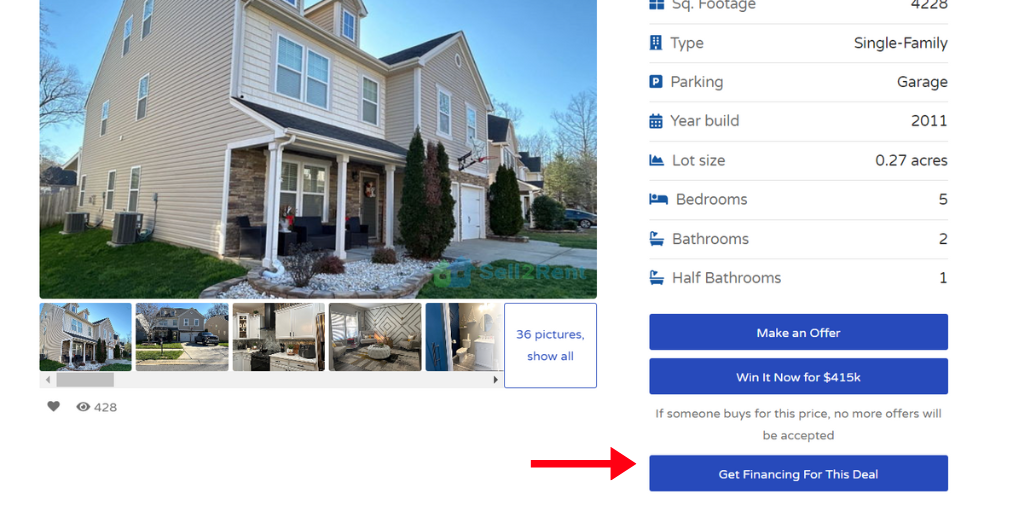

- Log in to the Deals site.

- Select the property you are interested in.

- Click on Get Financing For This Deal.

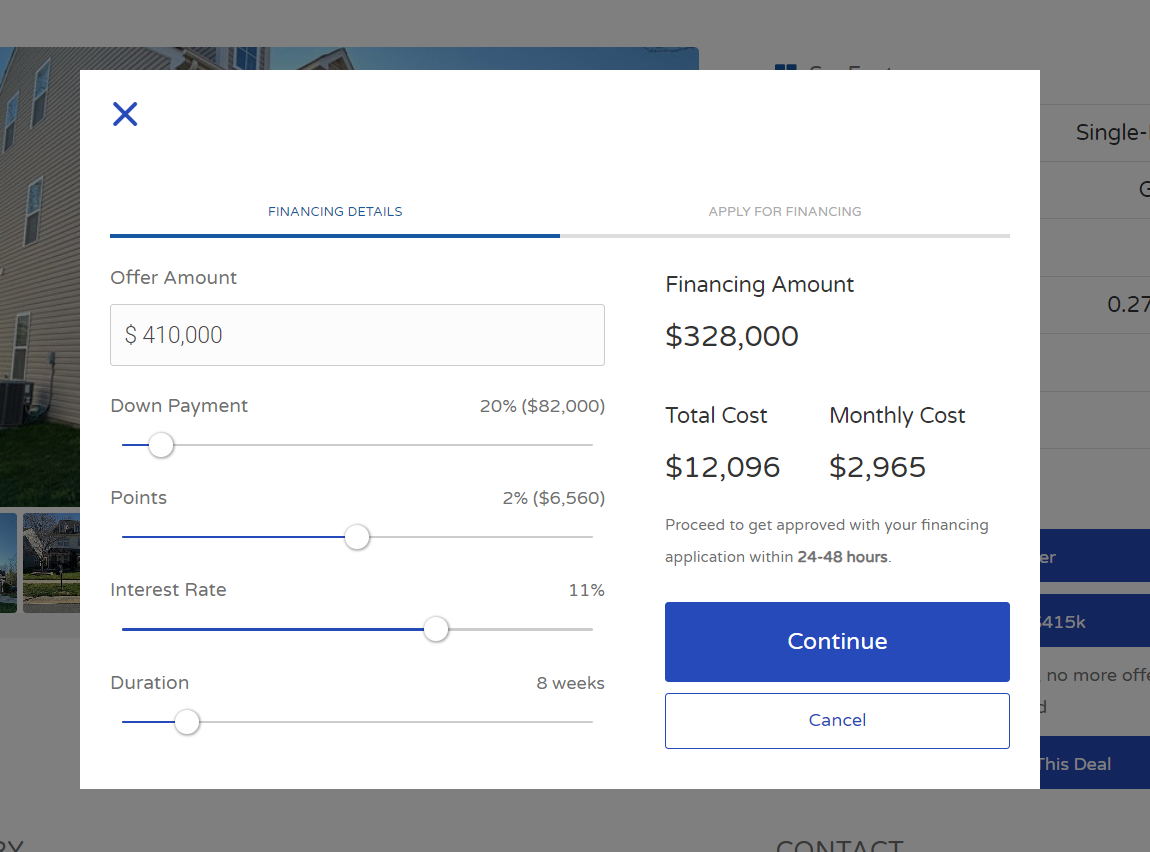

- A box will appear where you can customize your financial needs.

- After providing the required information, click on Continue.

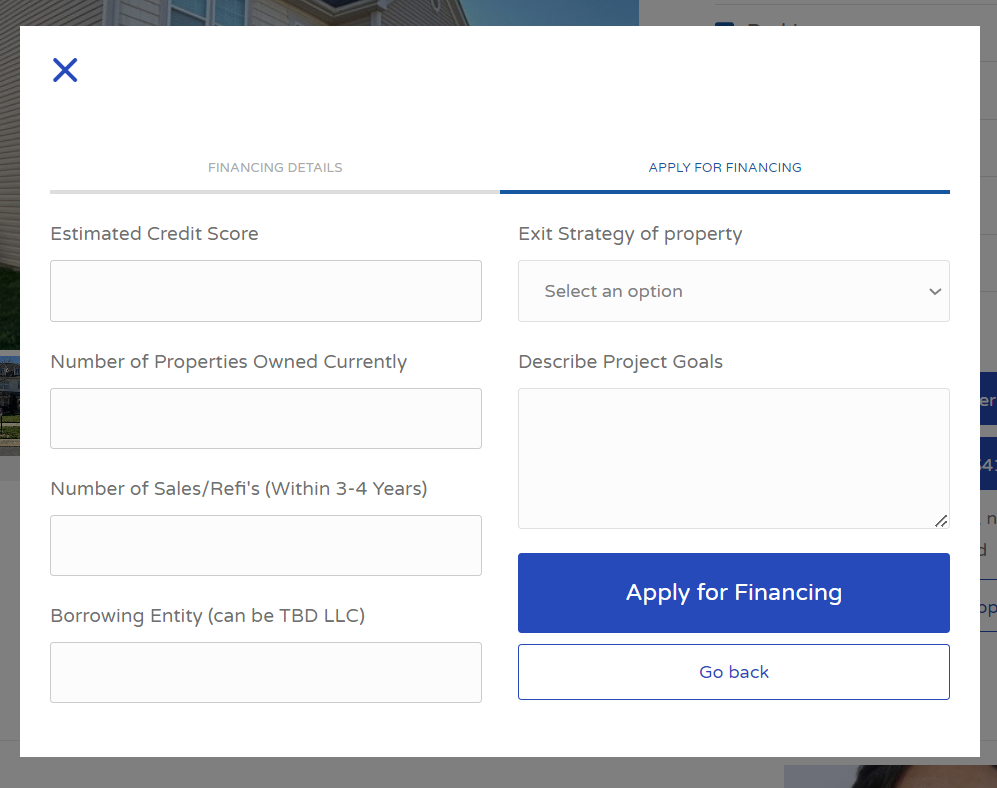

- Once you have completed the required information, click on Apply for Financing.

Understanding Each Requirement

-

Down Payment: The initial payment made when purchasing a property, usually expressed as a percentage of the property's purchase price.

-

Points: Also known as loan discount points, these are fees paid to the lender at closing in exchange for a reduced interest rate on the mortgage.

-

Interest Rate: The cost of borrowing, expressed as a percentage, that a lender charges for a loan.

-

Duration: The length of time, typically in years, for which a loan or mortgage agreement is set.

-

Estimated Credit Score: A numerical representation of an individual's creditworthiness, which lenders use to assess the risk of lending.

-

Number of Properties Owned Currently: The total count of properties that an individual or entity currently holds.

-

Number of Sales/Refi's (Within 3-4 Years): The total number of property sales or refinances within the specified time frame.

-

Borrowing Entity (can be TBD LLC): The legal entity, such as an LLC (Limited Liability Company), that is obtaining the loan.

-

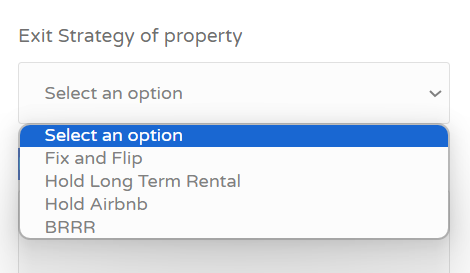

Exit Strategy of Property: The planned approach for selling or disposing of the property, outlining the intended outcome or profit strategy. The available options for this strategy include:

BRRR in real estate is an acronym representing a specific approach to property investment. Each letter in "BRRR" corresponds to a key phase of the process:

BRRR in real estate is an acronym representing a specific approach to property investment. Each letter in "BRRR" corresponds to a key phase of the process:

-

Buy: Acquire a property, typically at a price below market value, with the aim of making improvements.

-

Rehab: Perform the necessary repairs and improvements on the property to increase its value and appeal.

-

Rent: Place the property for rent to generate income through leases.

-

Refinance: Once the property has increased in value due to the improvements made, refinance it to obtain a new loan based on the improved value.

-

Describe Project Goals: A detailed explanation of the objectives and aims for the real estate project, outlining the intended outcomes and purposes.

Who Handles The Financing?

At Investorlift, the financing process is managed by external specialized companies. When financing applications are submitted, they are forwarded to these third-party companies, who handle the process entirely. It's important to note that those applying for financing should await contact from these entities. Investorlift does not have control over the process and timelines, as it is the external companies that manage these aspects.