Is there a way I can look up estimates or ARV details on any property?

How do we submit a deal to find its ARV?

Best answer by David Scheuerman

Hi Patrick,

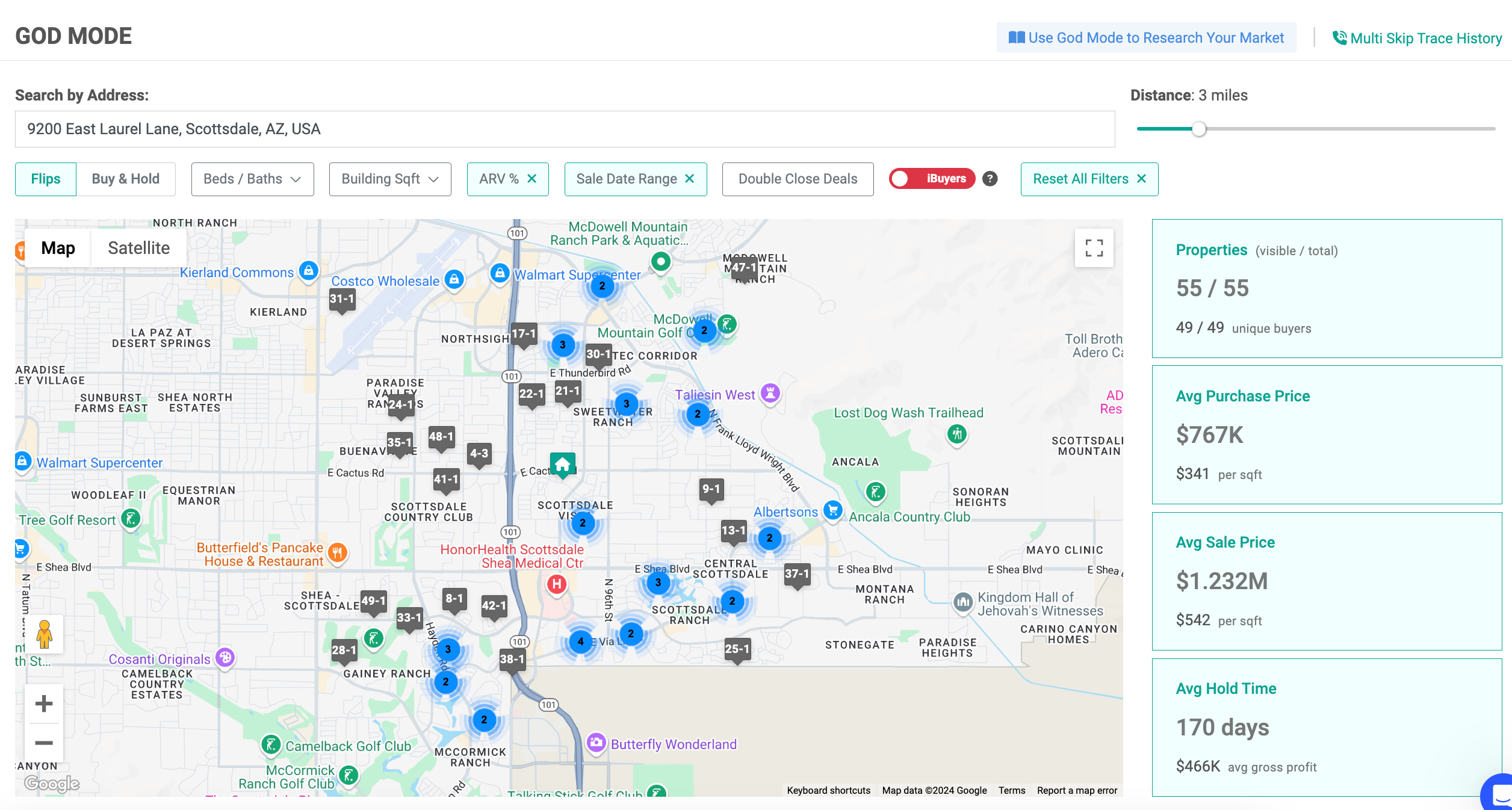

Investorlift isn’t a full comping tool, but it can provide helpful insights. The most accurate comps will come from properties recently sold on the market. However, you can also view off-market transactions like flips and rentals using God Mode.

Here’s how you can use it:

- Enter your property address in God Mode.

- Set a radius of 1 to 5 miles (depending on your market).

- Set Sale Date Range and ARV% (30-80%)

- Look at the average purchase and sale prices in the area. This will give you a general idea of what pricing would attract an investor.

Example:

For this property in Scottsdale, AZ, there were 55 flips in the past year (use the "Sale Date Range" filter and 35-80% ARV). On average:

- Purchase price: $767K or $341/sq ft

- Sale price: $1.232M or $542/sq ft

If my property is 1,800 sq ft, an investor might buy it for around $341 x 1,800 = $613,800.

Keep in mind, this isn’t a complete comping tool since it doesn’t account for property condition or repair costs. But it’s a great starting point!

Let me know if you have questions!

Best,

David Scheuerman

Login to the community

No account yet? Create an account

Connect through your Investorlift account

LoginEnter your E-mail address. We'll send you an e-mail with instructions to reset your password.