Hello everyone!

I’m Jake Hill, and I’m thrilled to share my experiences and insights from our journey with Investorlift here on the forum. My company, Find The Blueprint LLC, embarked on our adventure with Investorlift on August 16th. Although we had previously used Investorlift, our recent experience has been a game-changer, and I’m excited to share what has worked for us.

A Bit About Us:

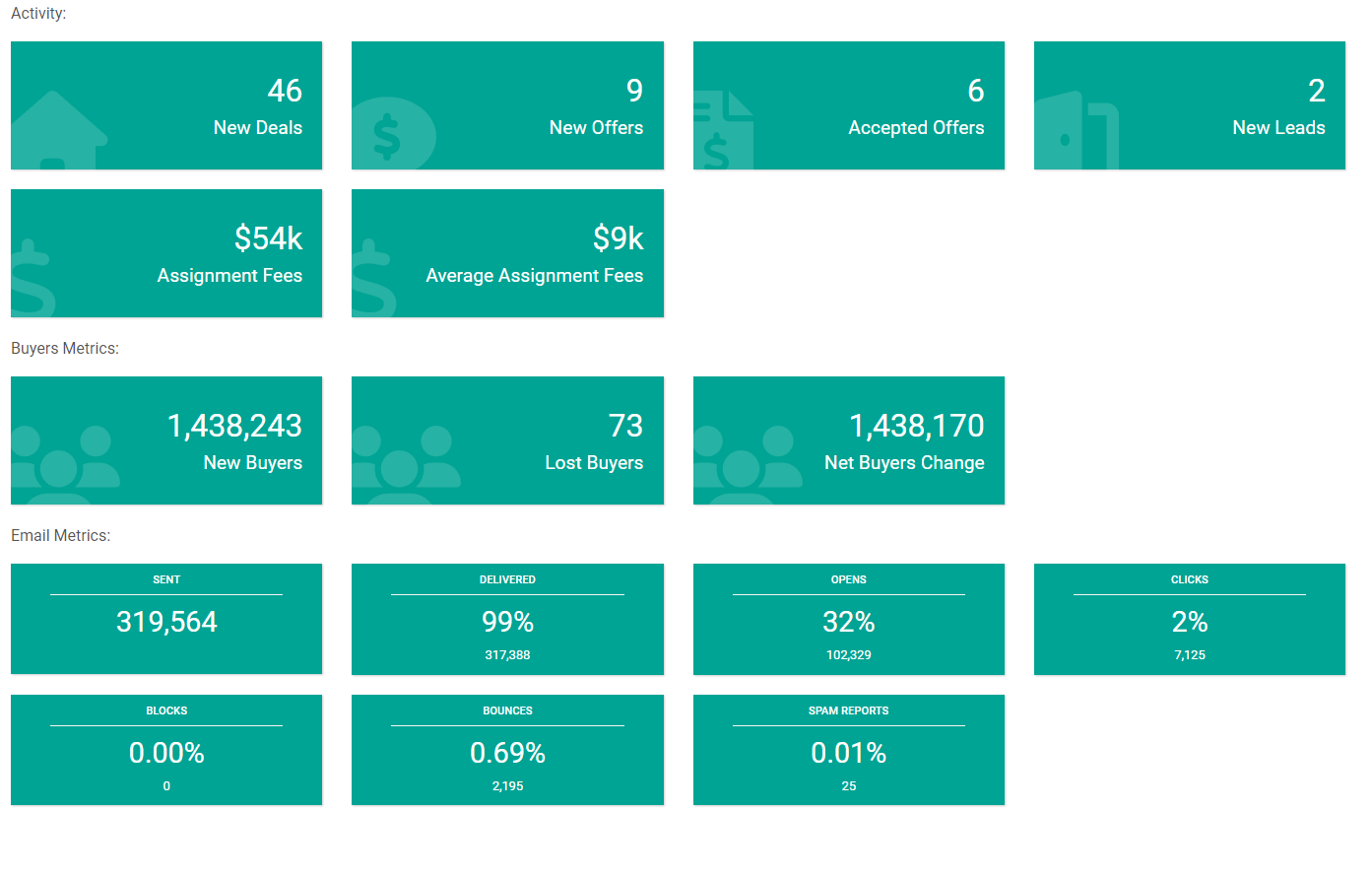

Find The Blueprint LLC has been wholesaling for three years, with one year using Investorlift. In our first month alone, we generated over $54,000 in revenue. This success is largely attributed to our strategic approach and our commitment to leveraging the tools and insights available through InvestorLift.

Key Practices and Tips for Success:

-

Listen and Learn: We made it a priority to absorb as much knowledge as possible by listening to Investorlift podcasts and engaging with the community. This helped us understand best practices, who to collaborate with, and how to optimize our strategies.

-

Build a Loyal Team: One of our key requirements when building our team was loyalty. We focused on finding individuals who were committed and aligned with our vision, rather than solely on their experience. This approach helped us create a cohesive and motivated team.

-

Efficient Buyer Outreach: We start our process with an email campaign targeting 1,000 buyers, followed by another campaign for 2,000 buyers within the next hour. This systematic approach allows us to cast a wide net while keeping the campaigns timely and relevant.

-

Leverage SMS Communication: After our email campaigns, we send SMS messages to 100 selected contacts. This targeted approach ensures we engage with interested parties directly and promptly, maximizing our outreach.

-

Optimize Credits and Track Interactions: We carefully manage our credit usage, spending around 1,000 credits per deal. Additionally, we use Artemis mode to monitor interactions and adjust our strategies in real-time based on how buyers are engaging with our listings.

-

Rapid Response Time: Our property inquiry response time is under 1 minute and 30 seconds. This swift response is crucial in maintaining buyer interest and closing deals efficiently.

-

Maximize Platform Usage: Our team logs around 390 hours per week on Investorlift, ensuring that we are fully utilizing the platform’s capabilities to drive our success. All team members work on a commission-based model, which incentivizes productivity and results.

Conclusion:

In summary, our success with InvestorLift has been driven by a combination of listening to expert advice, building a loyal and dedicated team, and implementing efficient processes for buyer outreach and engagement. By optimizing how we use Investorlift and staying responsive to market dynamics, we’ve been able to significantly boost our performance and revenue.

I hope these insights prove helpful to you and your teams. Feel free to ask any questions or share your own tips and experiences!