Hey community!

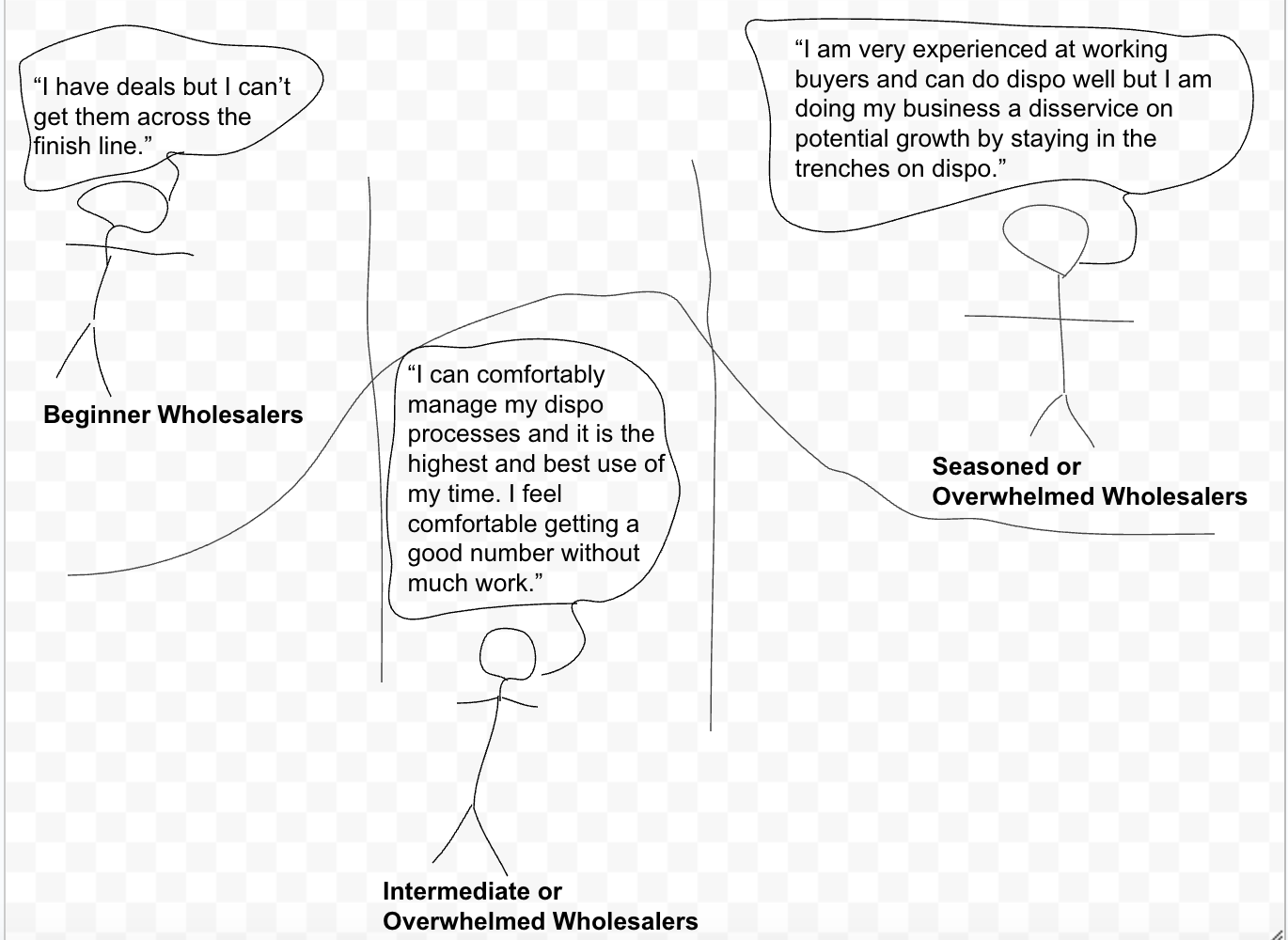

Do unprofessional daisy chainers waste your time - or are you just failing to leverage them to your advantage? 🤔

You post a clean deal on Investorlift.

Next thing you know - your phone blows up with 20 people trying to resell it. 😤

No control. No real buyers. Just noise.

But here’s the question: Are they clogging the system... or could you actually use them to close more deals?

👇🏼Drop your take.

⚡Tired of unprofessional wholesalers? Or are you turning chainers into closers?

News

⚠️ REAL TALK: The Daisy Chain Disaster: Is Wholesaling Broken or Just Evolving?

Login to the community

No account yet? Create an account

Connect through your Investorlift account

Loginor

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.